Are you pondering adding gold to your assets? Two popular options present: a Gold IRA and owning physical gold. Both provide potential benefits, but which is the best choice for you? A Gold IRA allows you to store your gold in an fund that offers tax advantages. Physical gold, on the other hand, provides you physical ownership of the metal. Before making a decision, it's important to analyze your financial goals and risk tolerance.

- Considerations to consider:

- Tax considerations

- Accessibility of funds

- Storage costs

Consulting with a expert can guide you in making an informed decision that suits your individual goals.

Gold IRA versus 401(k): A Retirement Battle

Deciding amidst a Gold IRA and a traditional 401(k) can feel like navigating a labyrinth. Both offer enticing options to secure your future, but their strengths diverge significantly. A Gold IRA, as the name indicates, allows you to invest in physical gold, providing a potential safeguard against inflation and market volatility. On the other front, 401(k)s offer tax advantages during your working years, with contributions often made pre-tax. This means you settle taxes only when you access funds in retirement.

- Weigh your personal financial strategy. Gold, being a tangible asset, can offer stability but may not always perform the same high returns as stocks.

- Delve into both options thoroughly. Understand the costs associated with each and how they influence your overall earnings

- Consult a qualified financial advisor to determine which strategy aligns best with your goals.

Uncovering the Pros and Cons of a Gold IRA

Considering an Gold IRA as part of your retirement planning? This type of IRA permits you to invest in physical gold, potentially offering a hedge against inflation. However, before investors dive in, it's essential to carefully weigh the advantages and disadvantages. Some benefits include Gold IRA fees likely portfolio diversification and a concrete asset to which you can own. On the flip side, Gold IRAs often come with increased fees than traditional IRAs and may involve detailed account management. {Additionally|Furthermore, remember that gold prices can be fluctuating, potentially impacting your returns.

- Consider about your overall investment goals and risk tolerance before deciding if a Gold IRA is right for you.

Leading Gold IRA Accounts: A Comprehensive Review

Are you considering ways to protect your retirement portfolio? A gold IRA might be the perfect solution for you. Gold has a long history of withstanding economic fluctuations, making it a appealing asset. However, navigating the world of gold IRAs can be tricky.

That's why we've compiled this in-depth guide to the top-rated gold IRAs available. We'll analyze various factors, such as account fees, client service, and investment options. With this knowledge, you can confidently choose the gold IRA that best accommodates your needs.

- Invest in precious metals like gold, silver, platinum, and palladium

- Protect your retirement savings from market volatility

- Spread your portfolio for greater financial security

Uncover the benefits of a gold IRA and how it can augment your financial planning.

Unlocking The Ultimate Guide to Choosing the Best Gold IRA

Embark on your journey to financial security with a Alternative IRA. These portfolios offer a unique opportunity to diversify your retirement savings by investing in physical gold and other bullions. With so many options available, choosing the best Gold IRA can feel overwhelming. This detailed guide will walk you through the essential factors to consider, assisting you to make an informed decision.

- Begin by understanding your investment goals and appetite. A Gold IRA can be a valuable component to a well-diversified portfolio, but it's important to match your investments with your overall financial objective.

- Next the standing of IRA providers. Look for companies that are established, licensed, and have a history of user satisfaction. Read online feedback and compare different providers based on their charges.

- Additionally examine the options offered for physical gold investments. Do they offer a wide variety of denominations? Are there initial investment requirements?

Ultimately the best Gold IRA comes down to your individual needs and factors. By carefully analyzing these key elements, you can find an IRA that satisfies your goals and helps you build a secure financial future.

Investing in Gold: Understanding the Advantages of a Gold IRA

A Gold IRA|is a specialized Individual Retirement Account (IRA) that allows you to invest in physical gold. Protecting your assets with a Gold IRA can offer several advantages. Gold is often considered a safe-haven asset, meaning its price tends to rise when the market experiences volatility or economic uncertainty.

- Furthermore, Gold IRAs can offer potential savings.

- Funding a Gold IRA can be a smart investment for investors seeking to preserve capital over the long term.

Before investing in gold, you should thoroughly research the potential downsides.

Val Kilmer Then & Now!

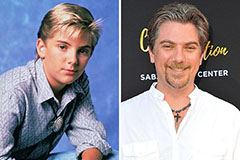

Val Kilmer Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!